Since 2021, the shipping situation from Asia, particularly China has been prone to change – mostly due to the Covid19 pandemic. The effects can still be felt now in 2023 – keep checking back here for regular updates on Asia to UK sea freight rates, the latest news, and what’s going on in the market.

January 2023 | Covid Outbreak Hits Chinese Logistics

The recent relaxation in the Chinese approach to Covid policy has seen a widely reported surge in cases in the county.

The Covid outbreak, which will welcome the start of 2023, is affecting nearly all of the logistical processes from the factories making the products, to truckers having to move freight to the ports and the Chinese warehouses that load goods into containers. We’ve even seen an increase in the number of cases in office-based administrative teams who manage documentation, operations and customs clearance.

This increased volume of staff absences across the board is creating a squeeze in the supply chain. In certain roles, such as truck drivers, the transport costs will increase due to demand outstripping supply.

Shipments on Exworks terms (where the UK importer is responsible for the Chinese Charges) are likely to see a spike in costs up until Chinese New Year is upon us in Mid-January. If you have bought your goods on FOB shipping terms, your supplier may try to push some of their increased costs in your direction if they don’t have access to transport, however, you may be able to push back on this.

Increases in costs and delays are almost inevitable in the short term but please don’t hesitate to give us a call on 0203 384 0498 if you would like any advice on how to best minimise the risk of these.

December 2022 | Reduced Volumes Lower Sea Freight Rates

As the new year approaches, we have seen the rates finally reducing pretty quickly over the last few months. As 2022 progressed volumes being shipped from China to the UK have been reducing due to the economic slowdown. As a result, shipping lines have had less cargo to fill their vessels which has led to a downward trend in prices as they fight to win business. Until consumers in the UK are able to see the light and the end of the tunnel as far as inflation and cost of living are concerned, we expect that the rates shouldn’t move too drastically up or down in 2023.

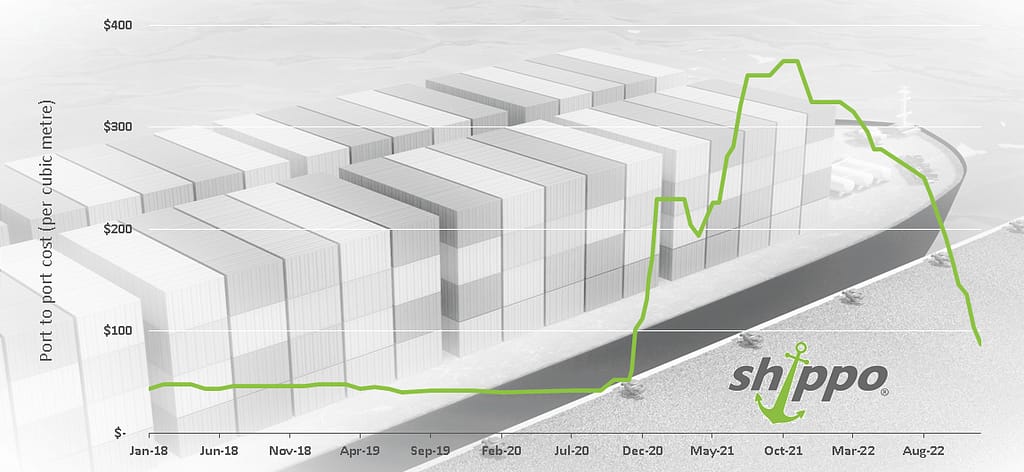

Increases in UK haulage costs will prevent the good times from fully returning but with the long-awaited reductions, freight rates are now much closer to pre-pandemic levels. However, overall, it’s great news for importers as shipping costs are much more manageable as we move into 2023. Here’s the overview from the last 5 years for context:

If you’re planning an import in January 2023, be aware of the Chinese New Year. In 2023, the year of the rabbit hops in on the 22nd of January so expect Chinese factories to be closed from around the 16th until the 29th.

September 2022 | Typhoon Hits Eastern China, Ningbo and Shanghai Ports To Temporarily Close

September 2022 | Second Strike for Felixstowe

Union staff at Felixstowe port have announced a second strike to run from 07:00 Tuesday 27th Sept until 06:59 Wednesday 5th Oct. This latest industrial action overlaps with the walkout at Liverpool port, between 19th Sept and 2nd Oct. So for 6 days, two major UK cargo hubs will be running extremely reduced operations.

This will have a knock-on effect on other ports such as Southampton which will have to compensate for the limited operations at Felixstowe

February - April 2022 | China Lockdown Timeline

April 2022 | Lockdown Update

Shanghai/Ningbo

We run our shared containers from both Shanghai and Ningbo. We often try to move goods between them to ensure the service is of the best quality and avoid delays when one port is running behind. Under normal circumstances, we would simply move goods that would have shipped via Shanghai down to Ningbo port to export from there. Unfortunately, due to the stringent restrictions and protocols in the region, this is becoming increasingly difficult. Available truck drivers with a valid PCR test, that are willing/able to travel to and from the warehouses are in short supply. To make matters worse, because Shanghai is closed it has increased the amount of shipments descending on Ningbo. This has led to queues of up to 4/5 days to get goods into port warehouses and this is by appointment only.

As it stands, we are currently expecting that shipments ready now, in the Ningbo/Shanghai region, are likely to be delivered to your door in the UK in late May/early-June, however, this expectation may change over the next week.

Shenzhen

Due to a recent Covid outbreak in Shenzhen, the local government has placed it in lockdown for an initial period of 7 days.

During this period all offices are closed, logistics activities are suspended and all truck and bonded warehouse services are suspended.

Nearby cities Dongguan and Huizhou have now also been placed in lockdown.

Delays for all shipments in this area are unfortunately inevitable as the whole process will be much slower due to the Covid checks in place.

Qingdao & Tianjin

Qingdao & Tianjin terminal operations are currently normal. Truck drivers must test negative 48 hours before travelling in and out of the port terminal.

This may have some influence on the nearby cities(such as some cities in Hebei and Shandong) due to local policies in place.

Guangzhou

At present, Guangzhou and the Pearl River Delta region (Zhuhai, Zhongshan, Jiangmen , Shunde , Foshan) remain unaffected and operate as normal.

What happens now?

Most of the shipping lines are currently working from home in both Shanghai and Shenzhen and there could be some delay in getting bookings and necessary documents.

March 2022 | Covid Epidemic in Wenzhou Area

China has announced a temporary lockdown within the Wenzhou area due to a Covid Outbreak.

This may affect those of you who ship from Ningbo, but the port itself remains open. During a lockdown, no goods are allowed to go in or out of the area.

Lockdowns tend to last around 2 weeks.

February 2022 | Covid Epidemic in Jiangsu Province

As of today, the Jiangsu Province in China has been put into temporary lockdown due to a Covid Outbreak.

Shanghai port itself is still up and running, however, if your supplier is in the parts of Jiangsu province that have been hit with restrictions there will be a couple of weeks delay.

In previous outbreaks, the temporary lockdown has lasted around 2-3 weeks.

May- June 2022 | Lockdown in Shanghai Intensifies

China is operating under a Zero Covid policy, Shanghai’s lockdown has now become even stricter than before which is going to have a massive impact on all shipments in that area and beyond. Suppliers who can move their goods are sending them to Ningbo instead, whilst this means the goods are moving it will contribute to ongoing congestion at the port. We have been seeing additional delays of a week or two before the goods can get to the port. Ningbo is operating at additional capacity and will be until Shanghai’s lockdown is lifted.

We are doing all we can to get goods initially for Shanghai sent to Ningbo instead but when shipping you will have to allow an additional week or so for your goods to be sent to the port.

How does this affect FOB Shipments?

Shipments from Shanghai can be transferred to our shared containers from Ningbo as that is the next nearest port. But not all suppliers will be able to transfer the goods to Ningbo, best to ask them ahead of time.

What about Ex-Works Shipments?

Unfortunately, despite general shipping rates coming down EXW costs are currently going up. This is due to the truck drivers having to wait outside Ningbo port entrance, the wait could be a day or a couple of days and this will incur additional trucking/delivery costs which may not be immediately apparent. We can still quote you on EXW but the costs may have to increase depending on said congestion.

This post will be regularly updated once we have any further information, if you have any questions please contact us.

January 2022 | China to the UK – Freight Rate Update

As we approach Chinese New Year in 2022, importers will usher in the Year of the Tiger along with the hope that the outrageous sea freight rates will start to soften.

Continued disruption in the shipping industry has kept the rates at unprecedented levels. Lack of space on vessels; global port congestion; a shortage of containers on the main routes; dodgy driving through the Suez Canal; and port closures/slowdowns due to Covid restrictions are among the main culprits for the pandemonium.

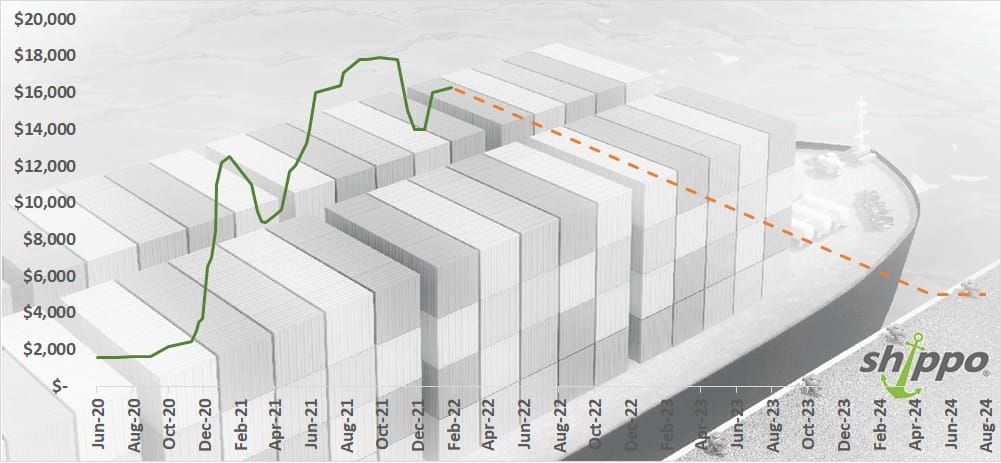

The graphic (below, minus the orange prediction line) shows that the industry was starting to recover in March 2021. Rates were starting to reduce following Chinese New Year in February but the Suez Canal blockage put pay to that. As the shipping lines tried to get vessels back on schedule and reposition their container stock, importers fought for the finite space on vessels. This led to a bidding war to get containers on vessels.

Sea freight rates increased every two weeks or so between April and November 2021. November and December saw some easing of the rates as volumes reduced following the rush to import goods for Christmas sales.

Each year, the lead-up to Chinese New Year sees an increase in the rates. China’s national holiday puts the brakes on most manufacturing for a couple of weeks. Four weeks’ worth of imports are essentially squeezed into two which increases demand dramatically. As expected, we have seen an upward squeeze in rates over the past couple of weeks, but it’s what will happen over the rest of the year that we’re really interested in finding out!

Current and future rates

If you’re planning to import (from FOB China to you in the UK) over the coming month or so, you may wish to use the below rates as a guide, however, these could be more or less depending on the exact details:

- 1.0cbm – approx. £550 + UK Duty & VAT

- 2.5cbm – approx. £950 + UK Duty & VAT

- 5.0cbm – approx. £1,700 + UK Duty & VAT

- 10cbm – approx. £3,000 + UK Duty & VAT

- 20ft Container – approx. £8,000 + UK Duty & VAT

- 40ft Container – approx. £13,000 + UK Duty & VAT

We’ve been trying to get hold of Mystic Meg throughout 2021 but she’s been engaged and is still unavailable for comment as to where the rates will be moving forward… so we’ll have to resort to market “intelligence” and a bit of intuition.

The shipping lines are knowingly charging more than they need to and there are two schools of thought surrounding whether there will be reductions or not over the coming months. We, at Shippo, are on the optimistic side of the coin and expect to see reductions over the coming months. However, there is a train of thought where shipping lines will do everything possible to keep the rates as close to the current levels as possible. This could be done by removing capacity (fewer vessels/services); missing out on previously scheduled ports or altering their schedules or the like. This would be done to ensure demand outstrips supply… and would almost certainly come with a further deterioration of the service quality.

Here at Shippo, we expect to see the rates start to reduce throughout the spring. Historically, there is less volume on the move at this time of year. However, it’s really difficult to know how quickly the rates will drop as the shipping lines will be trying to hold them wherever possible. Another factor is possible port closures in China due to Covid restrictions. We have recently seen a few port closures as they manage the pandemic, and naturally, with port closures come backlogs and an increase in demand that leads to rate increases.

We think it’s likely that it’ll take a couple of years to see the rates settle to their “new normal”. Our current prediction sees the rates snaking their way to around $5,000 per 40ft container by summer 2024 but that’s just our read on the market so we could be wrong. Rates will invariably ebb and flow with various unforeseeable market forces whilst increasing during peak season (late-summer/autumn) and before Chinese Holidays before reducing in the spring, but here’s what we currently expect to see as the general trend over the next couple of years:

We know this is just our opinion so can’t be taken as gospel but we really wanted to give you an insight into our thoughts so you can try to plan ahead. We know just how difficult it is to be an importer in the current conditions.

We hope this is useful and if you ever want to talk through your shipping plans, the rates, delays or get a market update, please don’t hesitate to get in touch with us on 0203 3840498 or contact us via our website.

2021 | Updates Overview

Summer 2021 | Rate Update

As we approach the halfway mark of 2021, continued disruption in the shipping industry is still keeping sea freight rates at unprecedented levels. Increased demand from importers; a lack of space on vessels; global port congestion; and a shortage of containers on the main routes have created the perfect storm.

Analysis of the rates over the past 12 months (our graph, shows 40ft container rates from China to the UK, port to port) shows that the craziness we described at the turn of the year hasn’t subsided as expected. This is mainly due to the knock-on effect of the Suez Canal fiasco at the end of March. When the Ever Given became lodged, a huge number of vessels and containers found themselves in the wrong part of the world. Once released, already congested ports and waterways were put under further strain as the vessels all descended at once.

The graphic shows that the industry was starting to recover. Rates were starting to reduce following the Chinese New Year in February. In short, the Ever Given put pay to that. Despite the increased demand, shipping lines are having to miss out on ports or change their planned schedules as they struggle to get their vessels back on track. This is exacerbating the problem as the lack of space on vessels is effectively creating a bidding war which leaves importers not only fighting for a “reasonable” cost but also space to actually ship their container.

Current and future rates

If you’re planning to import (from FOB China to you in the UK) over the coming month or so, you may wish to use the below rates as a guide, however, these could be more or less depending on the exact details:

- 1.0cbm – approx. £450 + UK Duty & VAT

- 2.5cbm – approx. £750 + UK Duty & VAT

- 5.0cbm – approx. £1350 + UK Duty & VAT

- 10cbm – approx. £2500 + UK Duty & VAT

- 20ft Container – approx. £6000 + UK Duty & VAT

- 40ft Container – approx. £12000 + UK Duty & VAT

I’ve called Mystic Meg but she was unavailable for comment as to where the rates will be moving forward so we’ll have to resort to market “intelligence”. The current rates could be in place at either these levels or something similar until after the Chinese New Year in February 2022. This is because there will only be a short window between the shipping lines being able to bring equipment back to their expected locations and the start of the peak season in the lead-up to Christmas. There could be reductions in July and August but expect these to be modest rather than a return to the rates of old.

What is Shippo doing differently?

I think I can speak for all of us here when I say that the past 6 months or so have been a real challenge. I’ve seen and heard every one of our advisors battling to secure space on vessels from China for customers. It’s not been easy.

As of January 2021, we have taken a business decision to politely decline all requests from potential new customers who want to use our service to ship full container loads. We don’t think it’s fair to our existing customers that we add more containers into an already challenging fight for space. So far in 2020, we have turned away over 500 leads with full containers. This is a decision we’ve made to maintain the quality of our service and protect our brand values.

When it comes to our shared containers, from the major ports in China, we are booking space in advance. We have at least two containers per week from the major ports so (unless the shipping line cancels the vessel) our representatives in China are doing well to secure space and keep our service levels high.

We are fully aware of the damage that these rates are causing to all importers and their customers. If you ever want to talk through your shipping plans, the rates, delays or get a market update, please don’t hesitate to get in touch.

March 2021 | Suez Canal Blocked

As of Tuesday the 23rd of March 2021, Egypt’s Suez Canal is blocked by a container ship that has run aground in high winds. This will have a knock-on effect on a lot of shipments being imported to the UK from Asia.

Here’s a link to the BBC story – https://www.bbc.co.uk/news/world-middle-east-56505413

In addition to the already disrupted industry, which has seen multiple delays due to global port congestion and lack of space on vessels, the grounding of the Ever Given will add to the delays.

The incident has already had knock-on effects as other vessels have been prevented from passing. Tugs and diggers are working hard to re-float the vessel but this could take days.

Approximately 10% of global trade passes through the Suez Canal with an average of more than 50 ships per day.

All Shippo’s customers, with goods on the Ever Given, have been contacted. However, if you are concerned about how your shipment may be affected, please get in contact. As soon as we have further updates we will keep all customers updated with altered schedules if your shipment is affected.

2020 | Updates Overview

December 2020 | Disruption Update

A severe lack of space on vessels has led to a bidding war, driving prices to these ridiculous levels. Rates for shipments in shared containers are around £115 more per cubic metre than 3 months ago. Costs for 20ft and 40ft containers on FOB terms are commonly around £7,000 and £11,000 + UK Duty & VAT respectively.Planning aheadRather than the rates falling as quickly as they’ve risen, we no longer expect a rapid fall in rates following Chinese New Year (CNY), but a gradual and partial return over a number of months from March 2021. Initial market intelligence expected rates to soften fairly quickly post-CNY (in February) as this would provide the break in proceedings that the ports and shipping lines need to return to an even keel.

The rates have increased so dramatically that it’s meant many importers are “waiting for the rates to drop”. We expect this to have created an invisible backlog of imports that are yet to be booked. As importers finally see a rate that suits them, or they can wait no longer, we expect a lot of these shipments will be booked, keeping vessels full in the spring.

Shipping lines may not see the empty space on vessels which is necessary for prices to be driven down by competition between the lines… unless the port congestion improves and empty containers are relocated appropriately allowing the shipping lines to run more vessels.

Plan for delays

If you’ve had a shipment on the move in December, we fully expect that you’ve been told about a delay to your shipment, when leaving China, arriving in the UK, or both. If you’re planning an import between now and Summer 2021 we would suggest that you add two weeks onto the standard shipping times to take these delays into account (although it could be worse on occasion).

If you know the outbound port and a ready date, please feel free to use our Delivery Estimator to plan ahead. Again, don’t forget to add two weeks onto the estimate due to the current level of delays.

These issues are breaking out of the industry press, hitting the mainstream media and are being raised in parliament…. but that doesn’t get your goods here any quicker or reduce your prices so we fully appreciate and understand the frustration that many importers feel!

Many of you will be aware of the ongoing delays at the Port of Felixstowe. Port closures due to storms/high winds, increased traffic and COVID restrictions have really taken their toll on the ability of the UK’s busiest container port to function as we’d like.

The Port of Felixstowe has now announced that they will not accept the return of empty containers that have left the terminal until further notice.

Shared Container (LCL) Shipments

Unfortunately, given that our consolidation containers from Southern and Northern China unpack outside the port, this will further delay the unpacking of the containers, which are already behind normal schedule. This will affect Shippo’s customers with shipments from Shenzhen, Guangzhou, Qingdao, Xingang and India among others.

Our containers from Ningbo and Shanghai are routed through Southampton so they may see a minor delay or a day or two due to the knock-on effect of shipping lines re-routing vessels but should be largely unaffected.

October 2020 | Felixstowe Port Delays

Many of you will be aware of the ongoing delays at the Port of Felixstowe. Port closures due to storms/high winds, increased traffic and COVID restrictions have really taken their toll on the ability of the UK’s busiest container port to function as we’d like.

The Port of Felixstowe has now announced that they will not accept the return of empty containers that have left the terminal until further notice.

Shared Container (LCL) Shipments

Unfortunately, given that our consolidation containers from Southern and Northern China unpack outside the port, this will further delay the unpacking of the containers, which are already behind normal schedule. This will affect Shippo’s customers with shipments from Shenzhen, Guangzhou, Qingdao, Xingang and India among others.

Our containers from Ningbo and Shanghai are routed through Southampton so they may see a minor delay or a day or two due to the knock-on effect of shipping lines re-routing vessels but should be largely unaffected.

Full Container (FCL) Shipments

Due to ongoing problems with the VBS (vehicle booking system), the port is only accepting a very reduced amount of trucks to collect containers from the quay. This is causing a huge backlog when booking full container deliveries. To counteract this, you may have noticed that your Shippo advisor may have been booking your delivery slot around two weeks in advance.

Unfortunately, these issues are exacerbated by the fact that hauliers are being held at the quay for many hours leading to some now refusing to collect from the port at all.

This has had a significant impact on our operations which we can only apologise for. We are doing everything we can to work around the situation, but with the situation as it stands, we are unfortunately limited in scope to what we can do.

We will ensure that all customers affected by delays caused by the issues at the port are kept fully updated with the progress of their shipments.

Get In Touch With Shippo

Thanks for reading and please keep coming back for the latest news and updates on the sea freight market in 2023. If you are importing goods and you want some help with freight solutions, feel free to contact us or grab a free quote.

Absolutely no hesitation recommending Shippo for international shipping and door to door transfer of goods. Zac Tullet has been superb dealing with more than one shipment on our behalf. Prices are competitive, communication is excellent guiding you through the whole process and regular updates are provided well before you start wondering where things are up to. Give them your supplier details, sit back and relax, your consignment is in very capable hands imho. David Cross