This content was reviewed for accuracy on 07/12/2023

When you ship goods from China to the UK, it can seem as though there are many hurdles to overcome, we’ve put together the 5 simple steps that you need to know.

Sourcing Your Product

To start off you need to know what it is you want to import. Whether you have a product idea in mind or an audience you want to appeal to, it’s vital to know your costs!

Even if you have chosen your product, the product type can affect the amount you’re going to pay in UK Duties and Taxes. It’s important to ensure you’re aware of what you’re going to be paying. You can check this by looking at the trade tariff website and looking up your product. We have a guide on how to navigate the trade tariff website here.

Make a note of the code that you think best describes your goods, as you’ll need this to declare your goods to customs before they land. Once you know what UK Duties and Taxes you’re going to pay you’ll need to know how much it is going to cost you to ship the products to you…

Confirming Your Product Costs

When you’re starting out, you may want to receive a sample from your supplier. You can get this shipped via a courier as it is likely to be a small amount (less than 0.5cbm or 100kg). However, if your product is larger than this then you may wish to look at sea freight as it will be cheaper. However, it does mean that you’re unlikely to get the sample for around 4-8 weeks as opposed to 1-2 weeks with a courier.

Once you’ve received the sample and confirmed that the quality is up to scratch, you can place your order of stock with your supplier. In order to get a quote for the cost to ship the bulk stock to the UK, you’ll need to ask your supplier for the following details:

- What shipping terms they are offering.

- The size and weight.

- The port they are looking to ship the goods from in China.

It is recommended that you agree FOB shipping terms with your supplier. This offers a split responsibility between yourself and your supplier as they cover the local fees in China to have the goods loaded onto the vessel. You’ll then be responsible for the shipping cost, UK Duties and Taxes as well as delivery to the UK. Once you have these details you can request a quote from a freight forwarder like us.

Finalising Clearance Details

Once the shipment has been booked in with your freight forwarder, they will contact your supplier to confirm the details of the shipment. They will then organise delivery of the goods to the port. Once a schedule is in place, your freight forwarder will require the clearance details. This ensures everything is ready for when the goods land.

The details required include:

- Your EORI number – this tells HMRC who is importing the goods, you can apply for this on the HMRC website through your government gateway account.

- The invoice for the goods that has been sent to you from your supplier.

- The tariff code mentioned earlier will also be needed as this lets HMRC know what goods you are importing and how much they need to charge for Duties and Taxes.

Expectations For Delivery

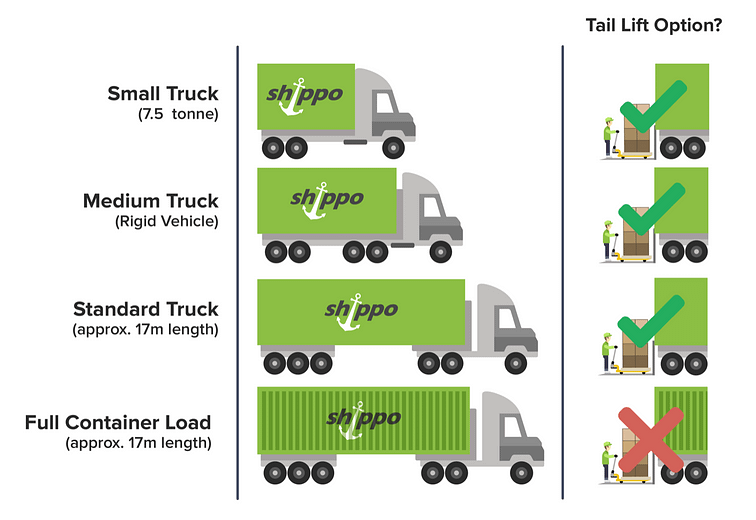

Within our cost, we include kerbside delivery. This means the goods will turn up to your delivery location on a truck which could be any size (up to a 40ft articulated vehicle). If the location cannot accommodate a vehicle of this size it’s important to let us know so we can request a smaller vehicle. This ensures you avoid any extra delivery charges which could occur if the driver cannot access the premises.

Kerbside, also means that it is your responsibility to get the goods off the vehicle as the driver is not insured to do so. However, the driver can offload the goods if a tail-lift is requested on the delivery. The driver will then use a pump-truck to wheel the goods to the tail-lift and lower the goods to the ground. It is still your responsibility to get the goods from the kerb to your building. Here’s our in-depth guide on what to expect from delivery.

These deliveries can only be requested if the size of the goods allows. If the goods are too big for the tail-lift then extra delivery requirements may be needed at an additional cost. That’s why it’s important to let your freight forwarder know your expectations for delivery.

Here’s an overview of the vehicle options for delivery:

Payment Terms

Some freight forwarders may include a deferment fee in their cost. This means they are charging you to pay the UK Duty & VAT on your behalf. We don’t charge for this service so the quote you receive will be accurate (unless the size of the shipment changes or there are any additions required).

We don’t require any payment until the goods arrive in the UK. Once the goods have cleared through customs and we have received the exact UK Duty & VAT figures through from HMRC, we will invoice you these figures along with the shipping cost. We require payment before we arrange delivery. We’ll then ask your preferred date and book this up once we’ve allocated payment.

If you have any questions or you’re ready with the details of your shipment please get in touch.