This post was reviewed for accuracy on 19/02/2024

Want to know your total costs to import your goods from Asia? You’ll need to know the UK Duty rating on your products. You can find this on HMRC’s Trade Tariff website… however, it can be a minefield, trying to find a commodity code that best suits your products.

We have put together a step-by-step guide on how to search for your products’ code efficiently based on the details needed to get to the right section. Read on, for how to easily navigate HMRC’s trade tariff website!

Finding Your Commodity Code

If you decide to find your commodity code yourself, you may find it helpful to read HMRC’s product classification guides so you know what their requirements are for selecting the correct code. You will need to search for your goods, so be prepared with:

- what your product is (some products will be easy enough to find just based on what they are – for example: mattresses)

*If you can’t find your product’s code based on what your product is, here are a few properties you should take note of to help you classify your goods:

- what they’re made from

- how they work

- how they’re packaged (classify items in a set separately if they can be used individually, otherwise classify by the main item)

Now that you’re armed with your weapons of mass classification, let’s get to how we find codes:

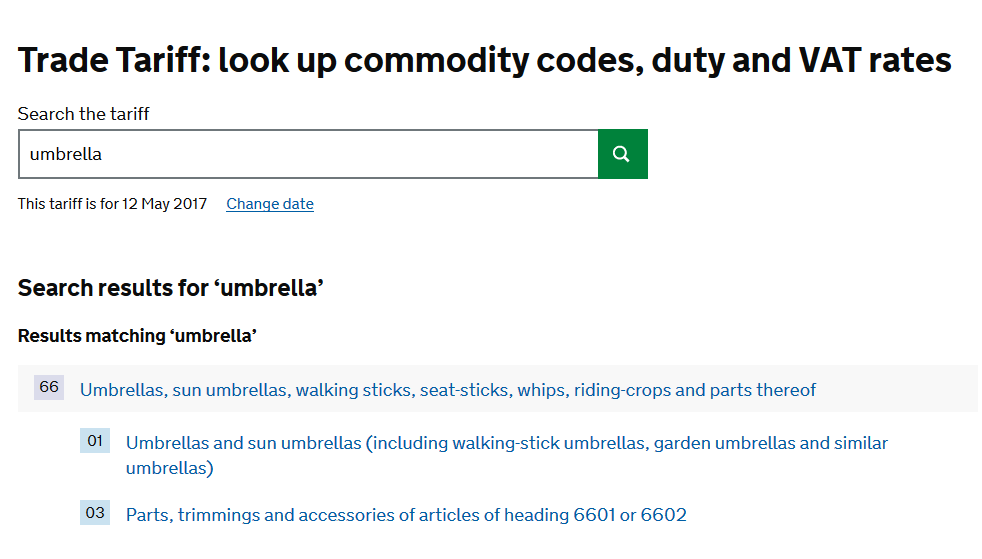

- If you’re really lucky, you can just ‘Search the tariff’! Some people just insert their product type and are returned with a clearly correct category and code . . . if this is you, feel blessed because your life just got a whole lot easier! We like to call easy-to-find products like these “golden bullets”.

This is an example of a “golden bullet” product; it’s very clear that umbrellas belong in the umbrella category.

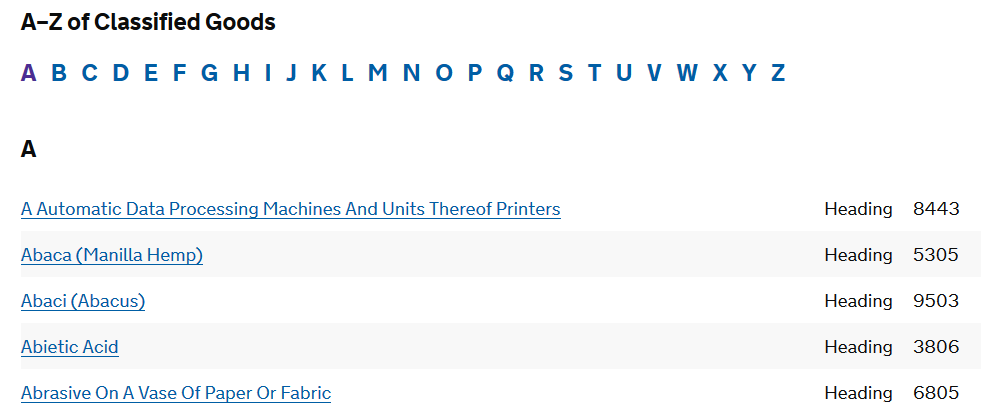

- You can also try searching the tariff alphabetically. While this may sound like an odd idea, having the tariff set out alphabetically allows you to scan items quickly and easily – and, if you’re stuck for ideas on what your goods may classify as this can be a good way to gain some ideas.

As you can see, having the Trade Tariff set out alphabetically makes it easy to scan for products.

- Go through the sections – this one is a real challenge as there’s just so much to go through. To ensure that you aren’t left in the dark, we can help you navigate this method too. Here is how we’d go about it:

- Click on the title of a main section; your goods should fall into one of these categories.

- Each category has sub-sections – click on the most appropriate one

- Even more sub-categories! You’re getting closer – use the same principle to click through to the headings

- Finally, you should have a list of options and associated codes; be careful which you chose, look at the descriptions in bold first

- Under the bold description, you may have one final option to choose exactly what type of product it is.

You can see the process to find the duty rating for umbrellas here; starting at Section XII, then getting more specific.

When you finally click through to the tariff code, there should be an overview for you to see the UK duty & VAT percentage.

Some commodity codes carry additional duties such as ‘anti-dumping duties’ you can check whether this applies to your products here.

If you use this route of finding your own tariff code, you don’t need to do it alone – you can call us here at Shippo and we’ll be happy to help you find it!

Contacting HMRC For Additional Help

If you require any extra help, you can get assistance with classifying your goods by emailing classification.enquiries@hmrc.gsi.gov.uk.For HMRC to help with selecting an accurate commodity code, you will need to include the below information about your product that will help to classify it: - Your company and contact name along with your email address and phone number.

- Country of origin.

- A detailed description of the product

- What the product is/does

- What it’s made of

- How the product works/functions

- How it is presented/packaged

- Highlight which of the below two options best describes your item (so it’s forwarded to the correct team):

- Agricultural/Chemical/Textiles/Ceramics (including food, drink, plastics, cosmetics, sports equipment, games, toys, clothing, and shoes).

- Electrical/Mechanical/Miscellaneous (including vehicles, optical and measuring devices, machinery, musical instruments, metal, furniture, lighting, paper, printed matter, glass, wood, and jewellery).

Applying For A Classification Ruling

However, if you want to be 100% certain when classifying your goods, you can apply for a Binding Tariff Information (BTI) ruling. This is free, but you may have to pay costs such as laboratory analysis (if classifying your goods requires it) this is legally binding in the EU for three years. You can apply online by following these steps: - Register for an EORI number if you don’t already have one.

- Sign up to use eBTI on the Government Gateway website.

- Sign in to eBTI and fill in an application.

You can provide images and information about your goods to receive a ruling, but you can also include samples.

HMRC require samples for the below products before they can confirm the code:

- textiles

- shoes

- ceramics

It’s important to note that the classification is not straightforward for all products.

For example, if you’re importing a stainless steel water bottle, the product can have a different commodity code depending only on one feature – such as whether it has a vacuum or not:

- If it is a vacuum stainless steel water bottle – 9617000000 (Miscellaneous manufactured articles/Vacuum flasks and other vacuum vessels, complete; parts thereof other than glass inners)

- If it is a non-vacuum stainless steel water bottle – 7323930090 (Base metals and articles of base metal/Articles of iron or steel/Table, kitchen or other household articles and parts thereof, of iron or steel; iron or steel wool; pot scourers and scouring or polishing pads, gloves and the like, of iron or steel /Other/ Of stainless steel/Other)

If you’re at all unsure of what code best suits your products it’s better to be safe than sorry as selecting a lower-rated code when the correct one has a higher UK Duty can get you in trouble with customs…so it is important to check with HMRC if it is not an obvious pick.

Calculating UK Duty & VAT

We’ve created a UK Duty & VAT Estimator so you can work out your approximate costs before committing to purchasing your products.

You’ll need your commercial value (how much you’re paying your supplier) a shipping quote and the UK Duty % which can be found on the HMRC website once you have selected an appropriate commodity code.

To summarize, the UK Duty is calculated on the cost of your goods + the shipping cost, then for the VAT you add the UK Duty cost and generally take 20% (depending on the product).

Get In Touch

Shippo have been our go-to for importing goods for our small business over the last 4 years. The team are helpful and transparent and keep us in the loop with regular updates when needed. Chris V has been our main point of contact over the last few years and he has been on hand to speak to when needed, friendly, easy to deal with and trustworthy. Very efficient and reliable service – Thank you!Ayesha MahomedHopefully, this little guide to navigating the HMRC Trade Traffic website to find your commodity code was helpful! If you are still struggling, we’re always here to give you a hand! Contact us or get a free quote.