Running a profitable business is not as simple as buying a product, selling it and keeping all the money. We could only dream! If you’re looking to import a product from China you don’t want to put all your time and effort into developing something that in the end will cost you more money than you’ll earn back. Today, we’re going to show you how product profitability when importing from China works out.

We hear from quite a few people who forget about key costs when initially working out their potential profit – often, thinking usually goes along these lines:

The product costs £1 per unit to buy wholesale and you’re selling it for £5, so there’s a £4 profit per unit! Unfortunately, the costs don’t end there.

When you’re calculating the profit a product has, you need to include all the costs incurred from your manufacturer’s door to your customer’s. That’s marketing, shipping, delivery, manufacturing costs, marketplace costs and more. What once looked like a £4 profit could just as easily be £1.50.

Luckily for you, today we’re here to help! Once you know what costs to include in your calculations, you can get an accurate overview of how much a product will really be earning you – and, from there, you can decide if you actually want to move ahead with it. (Oh – and, if you’re importing, we can help get your goods from your supplier’s country to your door hassle free too!)

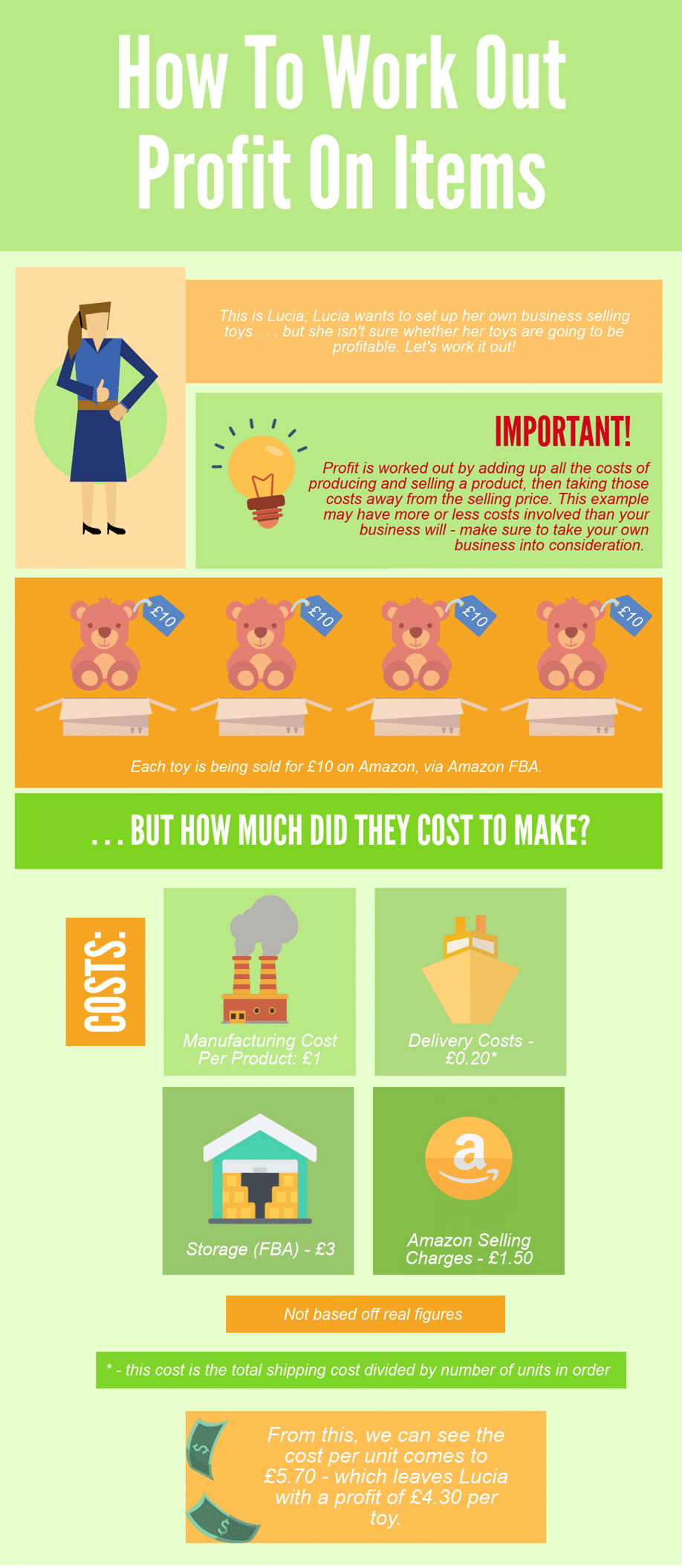

-

What Is Product Profitability?

We know, we know – you already know what profit is. Of course you do; but, just in case you don’t, we’ll go over it again.

Profit is the extra money you gain selling a product for more than it costs you to make and produce; the gap between the manufacturing and selling costs and how much someone paid.

Your profit is the money you earn through selling a product after you have accounted for the cost to make, sell and deliver it. Profit is completely free (after the tax man has paid you a visit!) to use money that does not need to make up the costs of production.

Arguably, profit is the most important metric for business owners; if you aren’t making a profit, you technically won’t be earning any money, as all the money you earn will be covering business expenses.

-

How Do I Calculate Product Profitability On Items?

You know what profit is and why it’s important… . now you want to know how to work it out.

-

6 Costs to Consider When Importing Products You Want To Make Profit On

Working out the total unit price of your goods in advance is absolutely essential to determining whether they’re going to be worthwhile to sell and whether your business is operating under a viable business model.

However, many people aren’t aware of what costs they need to factor in when working out the unit price, so today we’re sharing a few of the costs that you need to take into consideration.

-

Unit Cost

The cost per unit that your supplier provides you with is naturally the starting point of how much one of your products will cost you overall. This is often the cost that most people consider to be their final unit cost – but be wary because it is most definitely not.

On occasion, there may be extra costs to take into account for example if you use any additional services to find or verify the quality of your goods (such as sourcing agents or factory quality inspectors) factor these into the price.

-

Shipping Costs

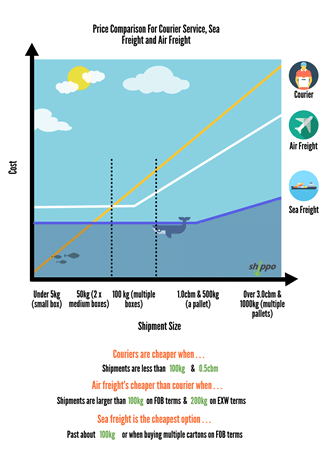

The cost of shipping is always a large expenditure; if you’re paying through-the-roof rates for couriers, you may want to look into sea freight to try to lower the overall cost. If you would like to compare the three different methods and their costs, we’ve written an informative post about it here.

-

Customs Costs

Customs Clearance can be another massive fee. HMRC charges Duties and Taxes that can sometimes cost as much as the shipment itself! If you know all your shipment details, we can actually help you work out your customs fees – and we can clear them on your behalf so that you don’t have to worry about it.

-

Storage Fees

Although a little more difficult to predict as you can’t be sure how long your products will remain in storage for, it is helpful to have an idea of how much your storage will cost you. Perhaps try to forecast the speed of your sale. If you’re paying for a warehouse to hold your stock then the cost of the product increases each week that the goods don’t sell, especially if your products are large.

-

Fulfilment (Packaging and Shipping)

Your packaging and shipping to your customers is another expense to factor in – especially if you’re using a third party Fulfilment Service (such as Amazon FBA). This can eat into your profit margin.

-

Marketplace Selling/Marketing Fees

A lot of marketplaces charge for selling on them – Amazon is an example of this. If you are planning to mainly sell through a marketplace, then it is worthwhile to research how much the marketplace selling fees will set you back. If you are not selling on a website like Amazon or eBay then you may incur costs to get your product to market, either by marketing or other means.

Taking all of these costs into account should make it easier for you to work out how much your total cost per product is. From there, you can work out how much you’re selling it for and whether the profit will be worthwhile. If your profit margin is slim or non-existent then maybe your current product isn’t the best business decision.

-

-

How Do Import And Shipping Costs Affect Profitability?

As we mentioned previously, your shipping cost can be a large expenditure and something you should focus on in details when determining if a product is viable.

- Determine how you are importing your products – Whether that be via a courier (if the shipment is below 100kg or 0.5cbm) or sea freight. Generally, your supplier should be able to advise which would be better suited for your sized shipment.

- If you are using a courier, don’t forget to take into account the charges for UK Duty & VAT.

A common question we are asked is ‘I sent goods via a courier and I was charged more than I expected when the goods landed’. You should do your Duty & VAT calculations prior to the goods being sent so you aren’t in for any nasty surprises. Couriers often charge a £10 – £15 deferment charge when they charge for UK Duty & VAT upon arrival in the UK. This is because they are charging for accepting the charges associated with your clearance, paying them on your behalf directly to HMRC and then charging them to you.

Shippo provides a similar service where we pay UK Duty & VAT on your behalf before charging the UK Duty & VAT to yourself at cost, however, we DO NOT charge any deferment charges at all – as we do not feel this is fair! (We pay Duties and Taxes on your behalf directly to HMRC as we have a long-standing account which ensures that there are no delays to HMRC as a result of a late payment of UK Duty and VAT).

- If your supplier suggests using sea freight, give us a call or get a quote to establish your full shipping costs. Our experienced team are more than happy to provide estimates of UK Duty & VAT so you can see all of your costings from the offset.

- Once you’ve determined your shipping cost, split the estimated costs against each of your units.

If you have different products, you’ll have to determine the volume/weight percentage of what each product takes up within the entire shipment so you can split the shipping cost to the associated product.

We provide a sea freight service which allows you to be as efficient as possible. With less than container (LCL) sea freight calculated per cbm, sea freight can work out to be much cheaper than air freight or courier solutions.

For example, if you are looking at shipping heavy products, it may be that your supplier has told you that there will be 25 cartons, totalling 1cubic meters (cbm) & 350kg of your products. If you are used to sending small shipments via couriers, you’d see a dramatic increase from your usual 30 – 50kg shipments which amount to a few hundred dollars, when 350kg works out to be in excess of $1000! Where a courier or airline will charge per chargeable kg, LCL sea freight solutions are primarily based on the volume; with that being said, you could ship 1cbm and 500kg and it would work out to be significantly cheaper than a courier alternative.

-

Selling on Amazon FBA & Amazon’s Costs

Amazon FBA – Fulfilled By Amazon

Selling on Amazon can be a minefield! It’s not like Amazon say ‘Here are the costs you should be expecting to pay when selling FBA’; you could spend days searching for an answer. Even then, how can you be sure you’ve taken everything into account?

Luckily for you, we help arrange imports from China directly into Amazon on a daily basis and we’ve seen it all!

Here is what you should be calculating when you plan to sell on Amazon FBA:

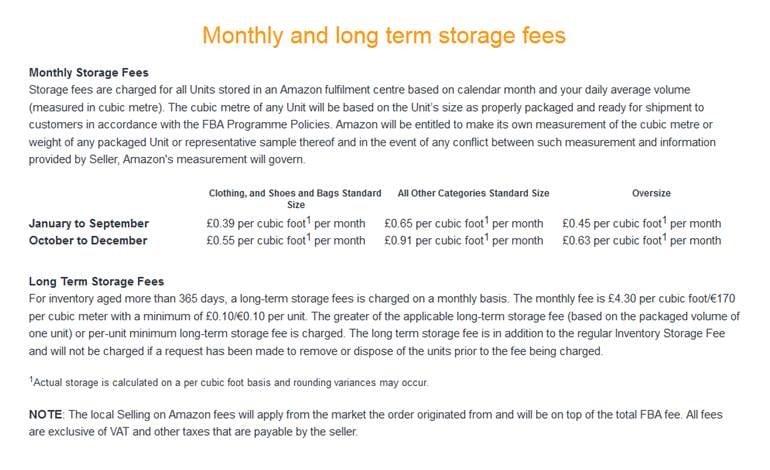

- Storage

Amazon storage charges are not easy to forecast, especially as you may not know exactly how your product is going to sell!

So when looking at importing and delivering directly to Amazon, don’t assume that your products will fly off the shelves. The harsh reality is that sales may start slow and over time you will grow with reviews, feedback and ranking positions.

Amazon charge storage per cubic foot (cu ft) per month. When forecasting your expected costings, remember that 1cbm is equivalent to 35.32 cu ft (cubic foot). That means if you were to ship 1cbm from China within being delivered to one of Amazon’s warehouse, you will be charged storage on 35.32 cu ft worth of goods; if your goods were toasters, for example, your costings may be something like this :

Calculating Amazon Storage Charges

£0.65 cu ft per month X 35.32cu ft = £22.96

You’ll have to take into account that when it comes to actually selling your goods, you could potentially sell 50% of your stock within a month, which of course will decrease the amount you pay in storage at the end of the month. But again, if this is a new product or line, or even your first time selling on Amazon all together you may not know how your goods are due to sell!

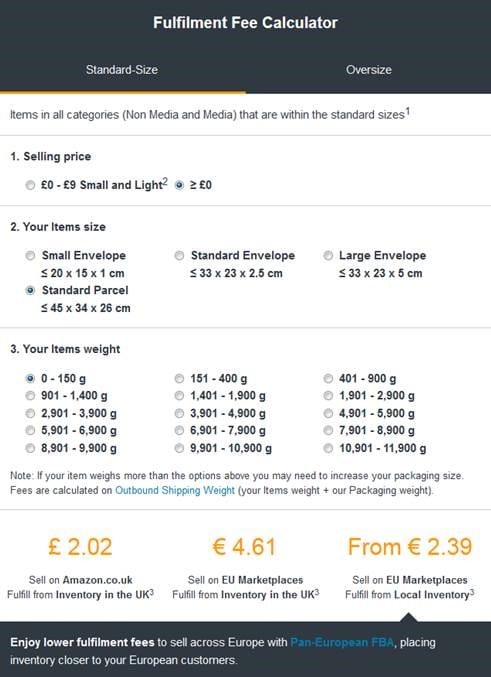

- Selling Fees

Amazon charges per sale of your goods. Pretty standard across all e-commerce platforms from eBay, Etsy, Shopify etc.

Amazon’s Referral Fee is generally between 7% and 15% depending on the item category. This is calculated based on the total amount paid for the product by the buyer (Inclusive of all applicable taxes etc).

This means if you are selling your toasters for £25 each, Amazon will charge as estimated for £4 for referral fees. You can use Amazon Referral Fees Calculator to help you get closer to your figures.

- Delivery Charges

Using Amazon FBA means that Amazon will fulfil your orders, saving your hassle of having to pop down to the post office every day with 10/20 boxes!

Of course, like anything, Amazon charges for delivering your goods. The price? That depends on the size of your goods.Your delivery cost will depend on whether your goods are considered as ‘Small & Light’, ‘Standard-Size’ or ‘Oversized’.

Here’s how Amazon categorise your goods when confirming delivery costs:

The Benefit of using Amazon FBA is that everything is handled for you. No need to worry about packing, posting or labelling. Couldn’t be much simpler than that!

-

How To Increase Product Profitability On Imported Chinese Goods

Sometimes, when someone thinks of ways to increase profit, their first thought may be ‘Sell at a higher price’; but as we all know, sometimes increasing the price of your product can price yourself out of the market, especially if you are already in direct competition with other sellers selling similar products.

Here are Shippo’s simple efficiency saving tips

- Switch from using a courier to sea freight

Switching from regularly importing via a courier to sea freight is a huge step, but it can be super cost-effective if you can pull it off successfully! When taking into account that sea freight is roughly a 6-week transit where a courier could be around a week transit.

It may be that you need to order a shipment via sea freight of a few cubic meters whilst you still courier of small shipments in the meantime and once your sea freight shipment has landed, you’ll see the cost savings and you’ll be on track for upscaling your business whilst you reduce your importing costings.

- Ensure that you are ordering as efficiently as possible

Ordering a large volume from China can cause cash flow issues for small businesses, sometimes you’ll find that you can add a few extra cartons than originally planned without increasing the shipping cost.

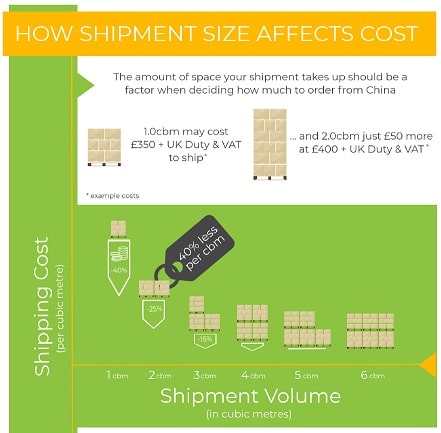

Here is an example of what we mean:

If you are looking shipping 12 cartons ; 0.5cbm & 250kg it may cost £300 + UK Duty & VAT. With that being said, you could ship an additional 12 cartons and it wouldn’t have too much of a change to the shipping cost.

If you’d like to see how you can be more efficient take a look at the below infographic or get in touch.

- Consolidate shipments

If you are importing goods from multiple suppliers on a regular basis, we would suggest that you look into consolidating your shipments. It’s fairly simple and can be extremely cost-effective.

Here is what to look for when considering if a buyer consolidation is right for you:

- Suppliers Location

We suggest the best way of consolidating is for your suppliers to be based around the same area or alternatively providing shipping terms to the same port i.e. Shanghai.

There is room for a little bit of movement – if you have two suppliers, your first supplier producing your toasters is offering FOB Shenzhen terms and your second supplier producing kettle is offering FOB Guangzhou terms, you could still consolidate these shipments. Guangzhou and Shenzhen are next to each other geographically and relatively close which makes it viable to consolidate.

- Shipping Terms

We suggest having all suppliers offer FOB (Free on Board) shipping terms to the same port. This effectively means that your suppliers are accepting responsibility to pay for all the local fees up until the goods are loaded into the container at the port.

- Volume/Weight

When looking at having a buyers consolidation, it’s best to ensure that you aren’t trying to consolidate shipments which are best sent via courier! Try to ensure that all shipments you intend to consolidate are 0.5cbm or 100kg or above. Anything less and you’ll find that the efficiency savings you are making can be less than the cost you are paying to have the shipment sent via sea freight.

-

Contact Shippo

We hope you found our guide to product profitability when importing from China helpful! If you want to have a go and have worked out how you can make a profit, don’t forget to keep us in mind for sea freight!

If you would like to find out more about the shipping costs and how using sea freight could reduce them, feel free to get in contact with us or receive a free quote.

Being new to the import industry the idea of bringing a container full of goods from the other side world was somewhat daunting. Shippo & Chris Veale in particular provided an excellent and thorough service: from a lengthy initial online chat regarding the ins and outs of the whole process to liasing with our supplier and arranging for the delivery on time and as planned. We cannot fault the service and rates provided by Shippo.Colin Minney