Quick answer: if your business has not turned over £85,000 in the last 12 months, you do not need to register for VAT, it becomes your choice. The long answer to do I need to be VAT registered as a first time importer? Well, you may want to grab a cup of tea…

What Is VAT?

It would probably make everything a lot more easily understood to have a clear picture of what VAT is and why you may be required to charge it.

Value Added Tax (VAT) is the charge added to the sale of goods or services by businesses. This charge is a tax collected by the business that they then have to hand over to HMRC. This is why VAT is often displayed as “£ Product Price + VAT“; it’s a separate charge that the business themselves aren’t charging – HMRC (Her Majesty’s Revenue and Customs) are.

Although the vast majority of products and services are subject to VAT at the standard rate (currently 0% in the UK) there are different VAT ratings for different products and services; some are even exempt.

If a business is VAT-registered, they effectively become a tax collector themselves; they are responsible for collecting taxes on behalf of HMRC. This is why businesses become legally obligated to register for VAT once their earnings reach a certain threshold – the government wants a piece of the pie. The flip side of this, however, is that when you are a VAT-registered company your business can claim back any VAT on purchases.

Being Legally Required To Register For VAT

As we’ve touched on before, in certain circumstances your business will be legally obligated to register for VAT. At the moment of writing, this is when your annual turnover reaches a certain threshold currently £85,000.

It’s important to note that the 12-month period is a rolling 12 months. This means that you don’t sit down in January and look at the past year’s earnings; you have to stay on top of your finances constantly.

If you aren’t turning over £85,000, then you aren’t legally required to register for VAT, but you do have the option to if you want.

NOTE

It’s important to be aware that you’re obligated to register for VAT if you’re taking £85,000 – not making a profit over that figure.This means that, if you haven’t reached the £85k mark, the question then becomes…

Should I Register My New Business For VAT As A First Time Importer?

We are asked this question a lot so, although we’re not accountants, we’ll don our capes and calculators and try to help you out.

Whether you should register for VAT if you aren’t over the earning bracket depends on the type of business you’re starting. If you’re planning on selling goods online through sites like eBay or Amazon then you may not want to be VAT registered until you have to be. If you’ll be selling to other VAT-registered businesses then it’s probably best to be VAT-registered. Let’s get into why.

Example

Setting the scene: you’re a cool little toy store. Getting good sales and great reviews – business is booming. You’re considering registering for VAT before you need to, but you want to work out whether it will save you money or not.

Let’s say that you usually buy in batches of 1,000 – so this time round you’re buying 1,000 toy cars. Your supplier in China is selling the cars for $3 each, the shipping cost is £300 and the UK Duty rating is 5% (take the below numbers as correct, but you can see how to work out UK Duty and import VAT here another time if you’re interested). Here is approximately what you’ll pay:

Cost of Goods : £2,500 (or $3,000)

Shipping : £300

UK Duty : £140

Import VAT : £590

So, you now have two main possibilities as far as the import VAT is concerned (for the sake of keeping this post simple and easily understood, we’re going to ignore other VAT schemes for now), either you’re VAT registered, or you’re not.

VAT Registered Not VAT Registered ✓ You reclaim the Import VAT on your VAT return ✘ You can’t reclaim the Import VAT ✘ You have to charge 20% VAT when you sell the cars to customers ✓ You don’t have to charge VAT when you sell the cars Here are the implications of being VAT registered on your bottom line if you’re selling the cars for £10 to the public:

VAT Registered Not VAT Registered Each Car Sells at: £8.33 + VAT £10.00 All 1000 cars are sold for: £8,330 + £1,660 in VAT £10,000 Now, remember that all VAT has to be handed over to HRMC, so you’ve lost £1,660 of the money that you’ve taken when you’re VAT registered. From here, you can see that your profit margins are higher without VAT even though the customer has paid the same £10 for the car – but don’t forget that being VAT registered means that you make your money back in a different area. If you’re VAT registered, then you would have reclaimed the VAT initially, so it’s a matter of whether the amount of VAT you can reclaim can outweigh the amount of VAT you collect.

You can see that to make the same profit when selling to the public if you’re VAT registered you have to sell your products at a higher price – which could send potential customers to another seller!

Let’s look at what the overall difference is in how money is paid/reclaimed:

VAT Registered Running Total Not VAT Registered Running Total Paid for the Goods/Shipping/UK Duty £2,940 -£2,940 £2,940 -£2,940 Paid for the Import VAT £590 -£3,530 £590 -£3,530 Reclaimed VAT £590 -£2,940 £0 -£3,530 Sales Revenue £10,000 (incl. £2,000 VAT) £7,060 £10,000 £6,470 VAT on sales (paid to HMRC) £2,000 £5,060 £0 £6,470 TOTAL GROSS PROFIT £5,060 £6,470 These figures should be taken with a pinch of salt as there will be other costs to run the business like packaging and delivery of the goods. These extra costs that have VAT would effectively be cheaper for the VAT-registered company as they can reclaim the VAT on these things too, but the concept is still the same.

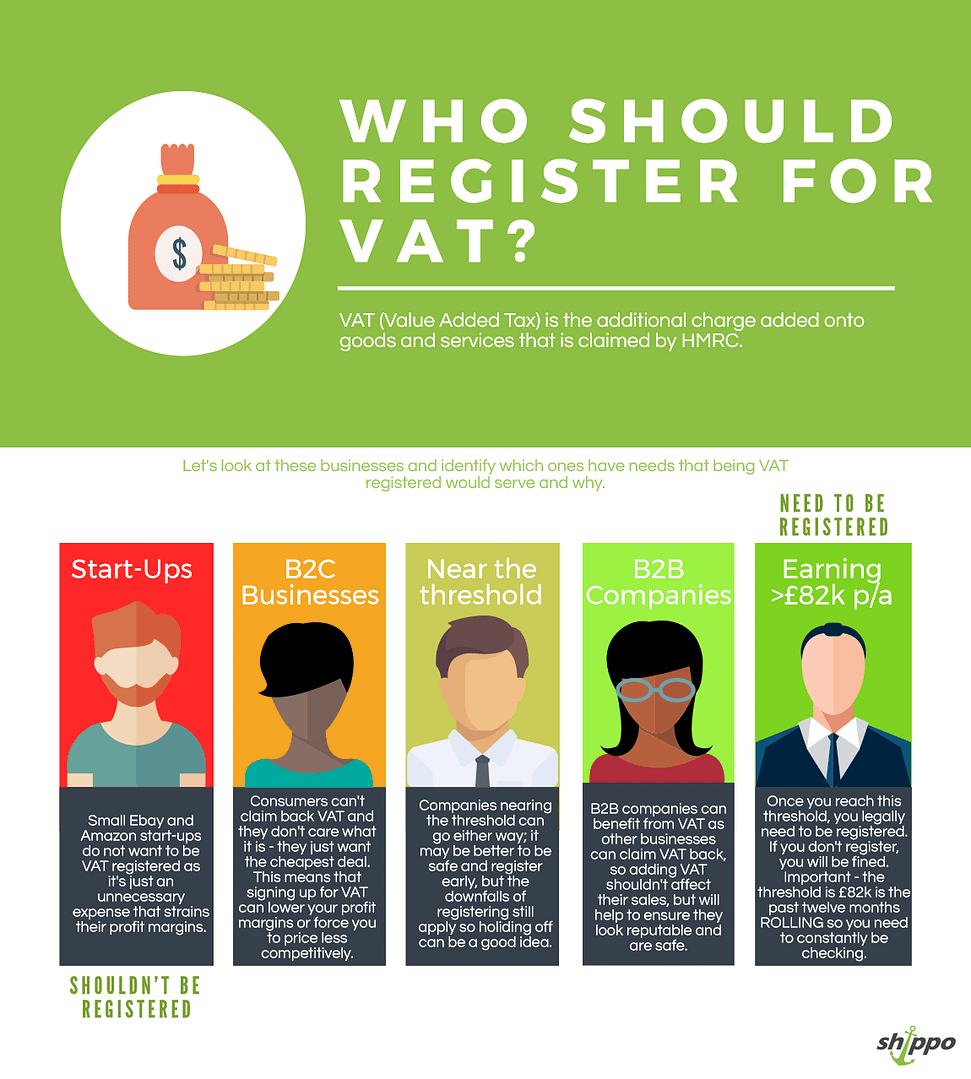

Who Should Register For VAT (Infographic)

Registering For VAT Pros and Cons

There are pros and cons to registering for VAT…you should sum both your options up carefully.

PROS

- Your business will look more professional and established.

Due to the fact that once your business starts turning over a certain amount you need to be VAT registered, not being VAT registered lets other businesses know that you aren’t earning over a certain amount. If you’re trying to market your business as an established and successful brand, it may help to be VAT registered as a sign of stature. - Ensures that you never slip up when you do hit the 85k mark.

This is especially true for businesses that will grow quickly. Opting into VAT means that your business is already part of the scheme, so if you do hit the 82k mark you’re already covered. (This is worthwhile because if you fail to register you can be fined.) - You don’t have to spend ages changing item prices.

Imagine you have a massive e-commerce website with over 1,000 products. You become VAT registered and . . . now you have to change every single one of your product prices…. or take the hit. - You can claim back VAT.

One of the most obvious positives to being VAT registered is that you can claim back VAT. This can significantly lower your business’s expenses if it takes a while to get your product/service to market.

NOTE – B2B

If you’re a B2B (business to business) company, then charging VAT should not be an issue. Other businesses, as opposed to consumers, will understand what VAT is and why you’ve charged it – but more importantly, they will be able to claim the VAT back if they are VAT registered too.CONS

- Lowers your profit margins when selling to the public

As you saw in the example above, if you are working to keep your products at a competitive price, you will likely have to swallow the difference – which means that you will end up lowering your profit margins and earning less money if you don’t sell to VAT registered businesses. - If you don’t eat the VAT, your price won’t be as competitive

If you don’t choose to sell at the same price to the public (moving from £10 to £8.33 + VAT, to still charge £10 in total) by absorbing the VAT charges, your prices will be higher, which means that they won’t be as competitive. This can lead to losing business to competitors.

- Your business will look more professional and established.

Contact Shippo

To summarise, there are situations in which you need to be VAT registered, but unless you’ve reached the £85k threshold it may not be worth it.

We hope this post was informative and answered any questions you may have about whether you need to be a VAT-registered company or not. If you have any questions don’t hesitate to contact us!

Working with the guys at Shippo was an absolute pleasure. They took care of everything including all the paperwork saving me time and hassle. I was kept informed of all developments and delivery was on time. Great value for money. Can’t recommend them enough.Marc Arnott