Someone famous once said the only things guaranteed in life are death and taxes. (That famous person was Benjamin Franklin.) This is true in importing too, albeit not the death part – when you import to the UK, you’ll need to pay UK Duty + VAT when your goods reach the border. That’s the bad news; the good news? Although you need to pay taxes, there are definitely ways that you can pay less. These are called Duty Relief Schemes.

-

What are Duty Relief Schemes?

A duty relief scheme is a scheme that enables you to pay less (and, in some cases, no) tax or duty on an import. There are multiple schemes that you might be eligible for depending on the intention of your import, what you’re importing and where it’s coming in from.

-

GSP Duty Relief Schemes

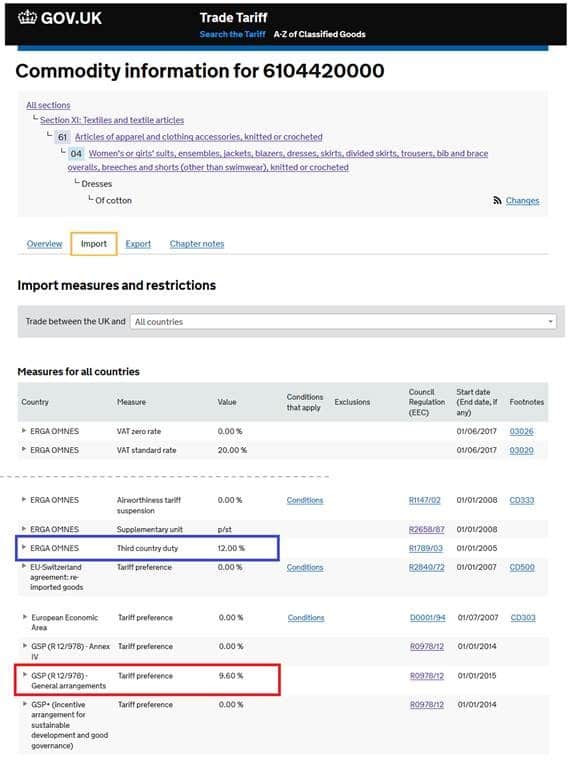

The main duty relief scheme is the GSP scheme. “The GSP (Generalised System of Preferences) scheme is an EU directive that allows for products being purchased from suppliers in certain countries to be lower-rated or even free from duty. This scheme is in place to allow businesses in developing countries to trade on a wider scale internationally.” – Import Duties and Taxes, Duty Reductions with the GSP Scheme.

GSP duty relief schemes are also known as “trade preferences”; this means you’re allowed to claim duty relief because the EU has a Free Trade agreement with the origin country.

To find out if you can claim one, the quickest thing for you to do is check your product’s commodity code in the UK trade tariff. Under each product’s details, you should be able to see whether it’s eligible for any duty relief schemes and the terms of the scheme

-

Other Duty Relief Schemes

In addition to duty relief schemes listed under the trade tariff, there are also schemes that are aimed at what you’re using the goods for and how long they’ll be in the UK.

Here are a few examples of duty relief schemes:

- Temporary admission; when you bring goods into the UK for designated, short-term use. (For example, an exhibition.)

- Inward processing; when you’re importing goods from outside of the EU to process then export (either to outside the EU or within the EU) you can claim duty relief.

- Outward processing; this allows you to export your goods to another (non-EU) country for repair or processing and then bring them back into the UK with full or partial duty relief.

- Customs warehousing; customs warehouses allow you to store goods duty and VAT free until they leave the warehouse.

- Community system of duty relief; if you’re importing products “for educational, scientific or cultural purposes; to encourage trade (for example, goods for test and commercial samples); for other purposes, for example: awards and decorations, when inherited, received as private gifts” (source: HMRC) you can claim duty and VAT back.

- Duty suspensions and tariff quotas for raw materials, parts and unfinished products; if you’re importing goods to finish or use as materials in the UK (goods/materials that are unable to be bought or bought in sufficient quantities from within the EU) you can claim duty relief.

The qualifiers that determine if you’re eligible for these duty relief schemes and how much you can save are:

- type of goods

- country the goods are being exported to

- country the goods originate in as set by the ‘rules of origin’

To claim a trade preference you need to:

- get the correct commodity code for your goods

- make sure your goods comply with the rules of origin

- be able to provide proof of where your goods came from

- make sure you comply with transport rules

-

Contact Shippo

If your goods are lucky enough to be eligible for a duty relief scheme, you can save yourself big money – so it’s worth looking into it! If you’re looking into shipping to the UK via sea freight and want help navigating the often unclear waters, feel free to contact us or get a free quote; we can take care of your transport door-to-door.

Fantastic company. I just started importing from China and there are so many unknowns with regards to duties, taxes and logistics. Shippo took care of everything and for a very affordable price. Always had quick response times for queries from Zac and anyone else I dealt with. I will be using these guys every time.Rohan Whelehan