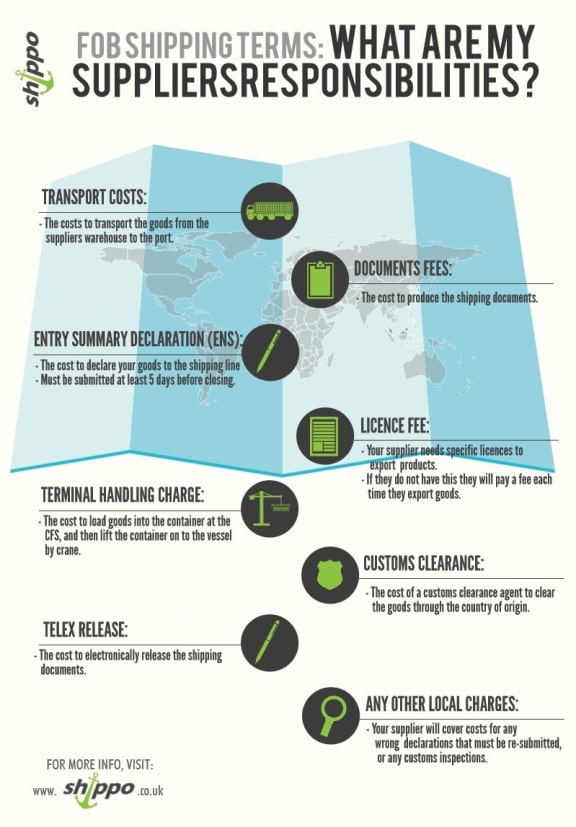

When buying goods on FOB Shipping terms, your supplier’s responsibilities stretch a lot farther than simply transporting the goods to the port of loading. This is an issue that constantly pops up, so we thought we had better explain it.

FOB shipping terms are the ideal option for importers as it’s the best way to control your costs. On these terms, your supplier covers all costs to get the goods onto the vessel and our quote covers everything from that moment onwards all the way to delivery at your specified address. The costs your supplier has to cover include:

Document fees

These are the costs to produce all of the shipping documents for your goods.

Entry Summary Declaration (ENS)

The cost paid by your supplier when declaring the goods to the shipping line. This must be submitted by 5 days before the closing date, or your goods will have to wait for the next UK bound vessel.

Terminal Handling Charge

This is the cost of loading your goods at the port. If this is not paid your goods will not even make it into a container, let alone on board a vessel. Once your goods are loaded into a container (by hand or by fork lift) they must be lifted onto the vessel by cranes.

Licence fee

Your supplier has to have specific licences to export products, if they do not have this then they will pay a fee each time they export goods.

Customs clearance

When goods are cleared through customs in the country of origin, a customs clearance agent is needed who will bill for their services and any costs from the local customs that may be incurred.

Transport costs

The costs to truck your goods to the chosen outbound port is also included, but as you can see it is far from the only cost.

Telex release

As technology has moved on, you will very rarely receive your shipping documents through the post. The most common way to receive them is via an electronic release. This is also billed to your supplier. Without the Bill of Lading to state you own the goods, you will not be able to receive them.

Any other local charges

On occasion the customs officer in the country of origin will want to inspect the cargo or may query something on the paperwork. If, for example, your supplier accidentally makes a mistake when declaring the goods, and customs request a re-submission then your supplier will also have to cover this cost. This works the same if there is a customs inspection or the goods had to be stored for any reason. If you were buying on ex works terms, all of these costs would be your responsibility.

To view our infographic – Click Here